Solar Dual-Purpose Achitecture

For years I’ve been interested in solar power. Each time I looked into it the price of a system, even with the tax incentives, with the cost of the lone (15 to 25 years) to pay off the system it would leave me with a higher power payment than I had before. The salesperson said that I would save money in the long run because the cost of power will continue to rise. “Fair enough” But I was looking for more than that, so I waited for the technology to improve.

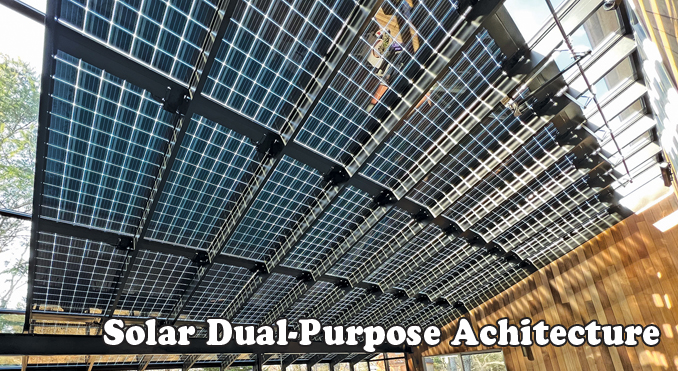

For years I’ve been interested in solar power. Each time I looked into it the price of a system, even with the tax incentives, with the cost of the lone (15 to 25 years) to pay off the system it would leave me with a higher power payment than I had before. The salesperson said that I would save money in the long run because the cost of power will continue to rise. “Fair enough” But I was looking for more than that, so I waited for the technology to improve.There is one company that incorporated solar panels into sunrooms. They worked with me to prefab the frame that would hold a modified solar panel of my choice. The panel was constructed of two pieces of glass with the solar cell mounted in-between leaving the space around the cells transparent and the final thickness measured 3/8” thick. Then I had a glazier add a ¼” piece of glass with an air space to it to make a 1” thick insulated unit that could be used as the roof glass. I used forty Prism 72 cell bifacial 365-watt Panels. With full sun the 40-panel system can produce 14,600W DC.

The cost of the structure and the solar equipment is eligible for Federal and State rebates. Federal Solar Investment Tax Credits have been extended for this year, for the third year in a row. The 26% federal solar tax credit is available for purchased home solar systems installed by December 31, 2022. NY State Solar Energy System Equipment Tax Credit is 25%. This state solar tax credit is available for purchased home solar systems in New York. (Max. $5,000 state tax reduction.) These incentives not only help the customer with state-of-the-art solar equipment, but can also knock a chunk off the price off the entire project…design, materials, site work, and installation!